Why transport modellers can’t forget about freight

1 November 2023

Freight is given sparse consideration by most transport models, but doing so glosses over the true importance of this vital task.

Freight is more important than you think

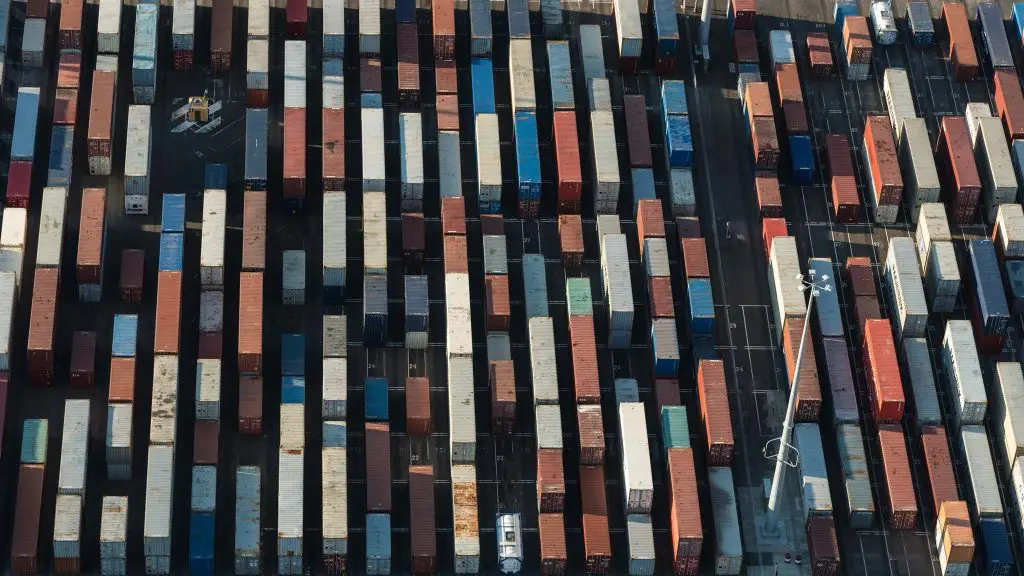

Most transport models concern themselves almost entirely with the movement of people, while giving the movement of goods a cursory glance. However, it’s easy to forget that most things we consume first arrive in a container at a port and that a supply chain delivers those goods to the point of purchase. We all buy at grocery stores and most of us still fill up our cars at petrol stations, which immediately demonstrates how supply chains support all our lives (and often in more ways than we consider).

Plus, with greater consideration for freight, transport modellers could help shape more efficient supply chains, resulting in fairer pricing for consumers.

Sparse data shouldn’t mean we do nothing

Freight tends to be modelled using employment as a proxy for economic activity, which can be a misleading guide to follow. The manufacturing process differs by good with some being more labour-intensive whilst others are simpler, more automated or require multiple processing steps undertaken across a set of geographically distant locations. This means that employment rates don’t always accurately predict where freight is coming from, going to, or how much of something is being produced and freighted. This can be particularly true for major distribution centres and warehouses where a small team of workers maintain a significant quantum of goods to be unloaded, stored, and ultimately sent to a final destination.

To help alleviate this inaccuracy, modellers should make the effort to look at the major commodity groupings and understand key supply chains for these goods, where they are being produced or augmented, and where they’re being consumed or exported. It shouldn’t just be “freight”. This understanding will help define what are the actual logistical tasks required to service that commodity. This does require more effort to build into a model framework, however, it is only by doing so that we can determine where the need for freight is the greatest – ultimately helping to deliver a better outcome.

Home delivery is more relevant than ever

The role of freight in its various guises has been changing over the past decade, and this has accelerated since the 2020 outbreak of COVID-19. Parcel delivery vans and light commercial vehicles are delivering in greater numbers and more frequently than ever before, with pandemic lockdowns and travel restrictions seeing the population change their buying behaviours – both in immediate and ongoing ways.

So, how are these trips affecting the way goods are moving around the country, and how do these movements affect the general population? The answers to these questions aren’t clear cut (at least not yet) and our historical data doesn’t account for the changes that caused them to arise. Theoretically, though, it could mean more freight and fewer people moving around our cities than ever before. Either way, these changes will have indelible effects on how people move, when they move, and why they move. What we don’t have is good sources of information on this changing phenomenon, and without robust and reliable information, most of the transport industry is simply ignoring the problem.

There are new datasets to use in models

We mentioned previously that most transport models are focused on the movement of people; however, the growth of aggregated location-based data from navigation devices in vehicles shows that there is potential to leverage datasets that track vehicles as opposed to people. Data aggregators are already in the market, but the biggest issue is the available sample size remains modest (though still potentially insightful).

There are other datasets that could also be better utilised, too. Containerised trade represents a significant component of the urban freight task, with most containers bound for a destination within a 40-50km radius from where they land. Further, containerised trade tends to be focused on a few key locations (the Port, intermodal terminals, major distribution centres, empty container parks etc), making it easier to potentially map out this supply chain and incorporate it into a strategic modelling framework. Federal Customs already log what is being imported and where it’s bound, but this information is assessed as commercially sensitive and is only available to government transport agencies. Unfortunately, most transport agencies are currently underutilising this information.