Has COVID-19 weakened the economic case for EVs?

17 June 2020

In 2018, the Australian Renewable Energy Agency (ARENA) released new predictions for EV uptake. Under a forecast moderate growth scenario, EV sales would pick up quickly from 2022 and represent 50 per cent of all vehicle sales in 2030. This means that 20 per cent of all vehicles on the roads would be EVs in 2030.

These forecasts rely on a series of assumptions regarding the different cost components of an EV and their Internal Combustion Engine (ICE) counterparts and on the rate of renewal of EVs.

However, COVID-19 has upended several of these assumptions, at least temporarily. A decline in the volume of vehicle sales delays the penetration of new vehicles in the overall fleet, meaning that new EV sales will take longer to translate into a meaningful proportion of EVs on the roads.

More crucially, COVID-19 has triggered a striking decrease in oil prices. With fuel prices currently hovering slightly above $1 per litre, the economics of owning an EV has weakened substantially compared to a traditional ICE vehicle.

Why are EVs so rare on Australian roads?

Australian capital cities appear to be ideal candidates for the rapid uptake of electric vehicles. With a sprawling geography and many commuters driving long distances every day, there is significant potential for savings due to the lower running costs of EVs compared to ICE vehicles. Notably, these distances can be achieved without going over the range of even the most affordable EVs currently being sold.

The low-density housing of Australian cities also means that a large share of households – close to 50 per cent in Greater Sydney, for instance – own two or more vehicles. A shorter driving range for one out of the two vehicles should not be a limiting factor.

Finally, the preponderance of detached housing and off-street parking makes it easier to install charging equipment, something that is much harder to do, and is a real impediment to the uptake of EVs, in denser cities.

Yet, EV sales in Australia are trailing behind most other OECD countries. Many cultural, social and industrial factors could help explain why EVs are not yet criss-crossing Australian cities.

One key explanation, though, is financial. It is common to pay more than $2 per litre for fuel in European countries, while prices in Australia are historically closer to $1.50 per litre [1], and that is before the recent COVID-19 related drop.

Modelling the impact of lower fuel prices on the likelihood of owning an EV

To understand the financial appeal (or lack thereof) of EVs, it is common to compare the Total Cost of Ownership (TCO) of an EV with that of an equivalent ICE vehicle. The TCO is the sum of all the costs that a car owner will incur, including purchase price, insurance and registration, maintenance, fuel costs etc, less the resale value. We have analysed the total cost of ownership of EVs and ICE vehicles for residents of Greater Sydney to gain insight into the impact of fuel costs as an economical barrier to the uptake of EVs. Using VLC’s Zenith model which yields a detailed breakdown of travel behaviour by travel zone, we have modelled the costs of owning both types of vehicles at a fine geographical level.

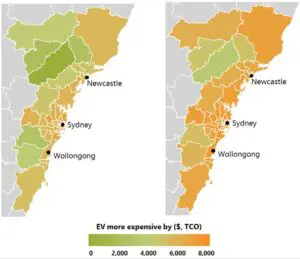

The maps below shows the average battery EV over-cost, compared to an ICE, for a medium-sized car [2], over a five-year period, by LGA for two petrol price scenarios. These numbers should be interpreted as simply representative, as driving behaviour, vehicle size and preferences, etc. differ markedly by household.

In both cases, EVs are financially more suitable to residents who live on the city fringes. With fuel at $1.50/L (map on the left) most of Greater Sydney still suffers from a significant over-cost, of more than $5,000, but a few rural LGAs almost reach TCO parity.

The over-cost grows with $1.10/L fuel (map on the right), meaning that EVs are for the time being, not financially viable. According to our analysis, less than 1 per cent of Greater Sydney, Illawarra and Hunter Valley residents should currently consider purchasing an EV from a pure return-on-investment viewpoint.

What about all these Teslas?

Car sales for the first months since the start of COVID-19 appear to give a positive message for EVs. In a depressed automotive market, EV and BEV sales registered strong year-on-year growth in April 2020.

However, a closer look at these sales numbers show that this does not go against our analysis. A large share of EV sales during April were Tesla Model 3’s, priced at around $80,000 against a comparable $60,000 for an ICE premium Sedan [3]. When typical savings to be expected from running an EV are below $1,000 per year, it is obvious that many current EV buyers are not purchasing purely for financial reasons.

As with most things COVID-19 related, it is difficult to forecast long-run impacts and the rate of return to pre-COVID economic conditions. However, by combining up-to-date information on technology and consumer behaviour with the wealth of information accessible via VLC’s strategic transport model Zenith, it is possible to analyse the effects of different fuel prices alongside almost any policy intervention on the EV market with precision. Such a model enables governments to design a targeted set of interventions to get the uptake of EVs back on track.

I would like to thank Simon Ho for providing the transport inputs to this article, Nancye Ng for her help with data and literature research, and Andrea Archbold, Gavin Nicholls and Daniel Veryard for their review and comments.

(1) Fuel prices in some US States with significant EV uptake is similar. However, these States have introduced clear policies and mandates to develop vehicle electrification.

(2) Full list of assumptions:

- Vehicles are purchased cash, and the analysis is conducted over a 5-year period. Registration and insurance costs are equal for both types of vehicles. Resale value is 50% of the purchase price.

- Typical medium ICE: Ford Fiesta, with a purchase price of $32,000 and an average consumption of 6.5 L/100km.

- Typical medium EV: Nissan Leaf, with a purchase price of $50,000 and an average consumption of 16 kWh/100km

- Electricity cost: NSW average of 31 c/kWh

- Maintenance cost is 7 c/km for an ICE and 5c/km for an EV.

(3) Such as an Audi A4.